Looking to add a new product or service to your organization?

Perhaps you’re an established business trying to prioritize your offerings, or maybe you need to enter a new market and forecast sales opportunities.

Calculating your total addressable market into your business plan can provide critical insight into the growth and revenue potential of your endeavor, which allows you to make more strategic long-term decisions. Oftentimes, this metric is underestimated or miscalculated, so it’s important to make sure your numbers are accurate.

What is Your Total Addressable Market?

Your Total Addressable Market (TAM), also called the Total Available Market, is a metric used to gauge your organization’s growth potential, or growth rate through the amount of demand that exists in that industry or market for your product or service.

In other words, it can show you the total amount of money you can make from everyone who could buy your product, regardless of the competition or any disadvantages in the market.

Calculating your TAM can help you build out a better business strategy for the future. Your business may have produced a product or service with a certain industry in mind but it may have the growth potential to be entered into an entirely new market. It’s important to figure out the risk associated with that move.

You may have a large market, but it could be oversaturated with similar products or services. Or, in the best-case scenario, you could find a small underserved market to focus on. In either case, your TAM can help you better define your industry and the needs of your consumers.

Most companies (unless they are a monopoly) cannot capture their TAM, as it’s almost entirely impossible to capture that much demand. Knowing the size of the target market is extremely helpful in calculating your TAM, although your TAM should be much larger than your target market since it requires eliminating competition and disadvantages.

If you sell business-to-business (B2B), you must make sure to include all of the industries your product may appeal to. Before moving forward, you need to understand exactly who will purchase your offering, or your market estimate will be inaccurate.

Define Your Target Industry

The first, and perhaps most important, step in this process is to define our market. So, before calculating the TAM, SAM, SOM, you need to answer three important questions.

- Who’s the buyer or decision-maker?

- Who’s the user?

- What is the scope of my market (Geographically and Demographically)?

The answers to these questions will provide a foundational basis for your calculations moving forward.

How to Calculate Your TAM:

Calculating your TAM is important not only for revenue potential, but it can also help you determine risk, attract investors, and find new opportunities.

Here are three of the most popular way to calculate this metric:

1. Top Down- One of the quickest methods, this starts with the largest possible size estimate of the market and reduces it down to subsets by using industry data, market reports, and research studies about your business and market.

An example of this might look like, “According to industry sources, Gartner, this is a $XX market by 2023” or “we serve ___, a $XX industry.”

Market sizing can be difficult since it means relying on secondary data or third-party information for making estimates. Because of this, it’s important to make sure your research is accurate, unbiased, and up-to-date as possible for the best results. You may want to hire a market research consulting firm to conduct fresh research that is focused on your need areas.

2. Bottom Up – This method is based on previous sales and pricing data, focusing on determining your local market size and then advancing to a larger population. This method is especially helpful if you are a medium or enterprise-sized business since calculation depends on a current analysis of your client base.

First, multiply your average sales price by your number of current customers to find your annual contract value or ACV. Then, multiply your ACV by the total number of customers. This will yield your total addressable market with reliable and tangible data.

Just as an example, let’s say you sell sunglasses in the state of Pennsylvania.

Using the formula: (A) # of Units X (B) Price = Market Size

You might sell an average of 60 pieces, at $35/pair, to these shops.

60 multiplied by $35 equals an ACV of $2,100.

Then, multiply your ACV ($2,100) by the total number of sunglasses shops in Pennsylvania (125) for a total addressable market of $262,500.

Seeing this information can help you determine exactly why a company would look to you for a solution, how you can price your offering, and how many of those units are able to be sold.

3. Value Theory- This method estimates the value your product or service may have in the market, including how much value consumers receive from your offering, and how much they’re willing to pay in the future for that offering. This method is helpful for smaller businesses, startups, or new business ventures.

Is it worth entering a new industry?

Companies often use this when expanding their main offering or when looking to cross-sell into existing customers. Think: This is how much value we can add, and here’s why we’ll be able to capture it.

Going back to our sunglasses example, let’s say you create a new pair of glasses that are easier to create, stronger, and last longer than anything currently on the market.

You’d identify your value theory by estimating how much shops would be willing to pay to carry your superior product. If “normal” sunglasses are being sold at $35 a pair, would shops pay $40 or even $45 for a pair of your new sunglasses?

Each industry has slightly different market viability sizes. According to market research, on average, it’s within reason to assume you can capture 2% of the market. If you capture 2% of the market, what will your revenue be? Combined with your expenses, this will let you know how viable your market is.

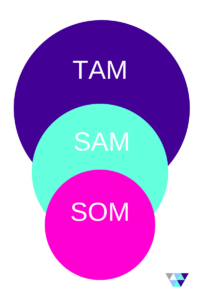

This can be broken down even further to Serviceable Available Market and Serviceable Obtainable Market, which we explain below.

Your Serviceable Available Market

The Serviceable Available Market (SAM) is a portion of your TAM, targeted by your products and services, which is within your actual reach.

Calculating SAM involves segmenting customers more strictly, based upon what kind of product or service they will deviate towards from their purchasing decisions. Aside from competitive, financial, or market limitations, other factors that lower a TAM into a SAM are geographic, cultural, and regulatory practices.

Your Serviceable Obtainable Market

Your Service Obtainable Market (SOM) is a portion of the SAM that you can capture. This will act as a short-term target and therefore is one of the most important. If you cannot succeed on a fraction of the local market, chances are that you will never capture a large part of the global market.

Chances are that you are not going to take 50% market share within 6 months. Therefore, your SOM needs to be a reasonable fraction of your Serviceable Available Market.

Need Help Calculating Your TAM, SAM, and SOM?

There are plenty of companies that can help you calculate your TAM. So, whether you are releasing a new product, looking for funding, or creating new pipeline goals, you should take the time to understand the deeper meaning surrounding your TAM, SAM, and SOM. The result of a well-defined total market size calculation will inevitably lead to greater sales success.

Remember, growth isn’t just about getting more customers, or a larger percentage of your TAM. It’s also about retaining your current customers and making sure your solutions meet their needs.